This past week on blog.alan.schram I managed to post once a day, every weekday at (around) 6AM. I managed to do this by writing the posts out a day or two in advance, and scheduling them to go up. So continue to check back on a daily basis, new content is going up all the time.

The week started off with a spending record. From there, I talked about motivation as well as the credit crisis. I then tried to tackle our own personal behavioral barriers in regards to money, like our ignorance and fear. Finally, I concluded the week with the conclusion that the biggest barrier to financial freedom is ourselves.

Next week, look forward to the continuation of the saving $100 challenge, as well as the beginning of a new series of articles.

My earnings at Associated Content continue to slowly rise, even though I haven't been posting any new articles. I have now earned twenty four cents, only a penny away from a quarter! My most popular article, to date, is How to Plan an Inexpensive Wedding. My least popular article is the newest one, How to Read Bass Tabs. Some good news on that front, I can now publish articles instantly, no longer do I have to wait and get them approved. Now I just need to write more articles.

Around the Web In Personal Finance

The carnival of personal finance (collection of personal finance links) went up Sunday night at Four Pillars. My favorite article from The Simple Dollar this week was "Quality of Life and Consumer Spending", an interesting read on the connection between spending, frugality, and what we deem as quality of life. Get Rich Slowly starts a conversation on what to do when saving money doesn't seem to be getting you anywhere. I also enjoyed reading how one woman became a millionaire.

What was your favorite article of the week? What are you enjoying reading? What do you wish you could see more of? Sound off.

Mar 21, 2009

Mar 20, 2009

The Biggest Barrier to Financial Freedom is Ourselves

If personal finance was easy, everyone would be a millionaire.

Financial freedom, as I'm learning, is a relatively easy process. All you have to do is spend less than you earn, save as much as you can, and then make that saved money work for you. All the rest, how to get out of debt, how you keep track of your money, what kind of car you drive, are details that might slightly affect how fast you achieve financial peace. There's no huge secret, and there's no magical formula. Spend less than you earn. Save as much as you can. Make that money work for you. Three simple things, and yet each of those is so incredibly hard.

Why? We're fighting ourselves. We know we have to spend less money than we earn, but we're given credit cards, and told that we need to build a credit history. We know we should save as much as we can, but then on what shall we watch TLC? We know we have to make our saved money work for us, but hey, I worked hard for that money, I deserve to go on a vacation.

The reality is, we have nobody but ourselves to blame for our financial situation. When I was in high school, I hated going to school. I eagerly anticipated leaving high school behind and going to college. It didn't matter to me how much money college cost, I was going to college, and I was going the year that I graduated from high school. While I was in college, I continued to not care how much each semester cost. Once I started, I figured I might as well go to the end, even though each semester was about six thousand dollars. So after four years of college, I ended up with seventeen thousand dollars of student loan debt, and no plan on how I was going to pay that back.

Sure I can blame the fact that I made the decision to go to college when I was 17 and didn't know what I was doing, or how much college really costs. I could point out that I had never even held a job for longer than four months at that point, and that I had never had to pay rent before. I was financially ignorant, but ignorance does not pay back my loans.

Now that I'm slightly older and slightly wiser, I find myself continuing to make less than wise decisions. While I do feel as though I have a better understanding of my finances, and a clearer goal of where I want to go with my money, I still make decisions based on the short term, and rarely think too far into the future. I buy dinner out because I don't want to cook, not thinking that twenty dollars could go towards debt repayment. I buy a game for my PlayStation because it looks like fun and I want to entertain myself, not realizing that it could have been fifteen dollars towards our wedding fund. I'll buy a beer or two without considering that the next day I have to work with a bank account ten dollars smaller than it was the night before.

My solution? I trick myself into saving by putting automatic withdrawals on my bank account for payday, leaving me with less money to work with in the first place. My ability to justify lattes and pizza is greater than my desire to save for my retirement.

Becoming financially free is not going to be easy. If it was easy, it wouldn't be worth doing.

Financial freedom, as I'm learning, is a relatively easy process. All you have to do is spend less than you earn, save as much as you can, and then make that saved money work for you. All the rest, how to get out of debt, how you keep track of your money, what kind of car you drive, are details that might slightly affect how fast you achieve financial peace. There's no huge secret, and there's no magical formula. Spend less than you earn. Save as much as you can. Make that money work for you. Three simple things, and yet each of those is so incredibly hard.

Why? We're fighting ourselves. We know we have to spend less money than we earn, but we're given credit cards, and told that we need to build a credit history. We know we should save as much as we can, but then on what shall we watch TLC? We know we have to make our saved money work for us, but hey, I worked hard for that money, I deserve to go on a vacation.

The reality is, we have nobody but ourselves to blame for our financial situation. When I was in high school, I hated going to school. I eagerly anticipated leaving high school behind and going to college. It didn't matter to me how much money college cost, I was going to college, and I was going the year that I graduated from high school. While I was in college, I continued to not care how much each semester cost. Once I started, I figured I might as well go to the end, even though each semester was about six thousand dollars. So after four years of college, I ended up with seventeen thousand dollars of student loan debt, and no plan on how I was going to pay that back.

Sure I can blame the fact that I made the decision to go to college when I was 17 and didn't know what I was doing, or how much college really costs. I could point out that I had never even held a job for longer than four months at that point, and that I had never had to pay rent before. I was financially ignorant, but ignorance does not pay back my loans.

Now that I'm slightly older and slightly wiser, I find myself continuing to make less than wise decisions. While I do feel as though I have a better understanding of my finances, and a clearer goal of where I want to go with my money, I still make decisions based on the short term, and rarely think too far into the future. I buy dinner out because I don't want to cook, not thinking that twenty dollars could go towards debt repayment. I buy a game for my PlayStation because it looks like fun and I want to entertain myself, not realizing that it could have been fifteen dollars towards our wedding fund. I'll buy a beer or two without considering that the next day I have to work with a bank account ten dollars smaller than it was the night before.

My solution? I trick myself into saving by putting automatic withdrawals on my bank account for payday, leaving me with less money to work with in the first place. My ability to justify lattes and pizza is greater than my desire to save for my retirement.

Becoming financially free is not going to be easy. If it was easy, it wouldn't be worth doing.

Mar 19, 2009

Ignorance and Fear

I think a lot of us are afraid. We're afraid because the economy is in the tank, people are losing jobs, there are multiple wars that we're engaged in, there are shootings where we live, and we don't know how the problem is going to be solved. We are afraid because we cannot see a solution to a problem we have a hard time defining.

But why are we afraid? What are we afraid of? Are we afraid that we might lose our job, and not be able to afford rent? Are we afraid that we won't have enough money to pay all the bills? Are we afraid for what our bank account might look like five years from now, or ten? Are we afraid of that looming debt, afraid that we might never pay it off? Are we afraid of the sacrifices we might be forced to make just in order to survive?

A lot of the time, I believe that we are merely afraid of the unknown. We fear the possibility of evil, the chance of adversity, the potential of pain. Take our finances for example. It is feasible that we might lose our jobs. We could run out of money, and not be able to pay all of our bills. We might not be able to afford to give a rent cheque next month.

These are problems, and all problems have solutions. The dilemma comes not from the problem, but from the reaction we have to the problem. Does the unknown scare you? Does that fear keep you from action? Do you know where your money is going?

The best response to this financial fear is abolishing the ignorance surrounding your money situation. If you are so afraid of your finances that you are scared to open up your bank account, or rip open the credit card envelope, then you need to take action now. Sometimes the truth will be better than what you thought, and sometimes it will be worse. Regardless, the only way to overcome the problem is by properly identifying what it is. Only then can you begin to come up with a solution. You can't solve a problem you don't understand.

Are you afraid? Don't delay. Don't think the problem will solve itself, or that someone will bail you out. Its time for us to grow up, own our money, and take responsibility for ourselves. Don't know where to start? Try keeping track of your spending with a spending record. Can't keep from spending every dollar that you earn? Try automatically putting it into a high interest online bank account. Face your financial fear. Understand and accept your situation, and from there, we can work on a solution.

But why are we afraid? What are we afraid of? Are we afraid that we might lose our job, and not be able to afford rent? Are we afraid that we won't have enough money to pay all the bills? Are we afraid for what our bank account might look like five years from now, or ten? Are we afraid of that looming debt, afraid that we might never pay it off? Are we afraid of the sacrifices we might be forced to make just in order to survive?

A lot of the time, I believe that we are merely afraid of the unknown. We fear the possibility of evil, the chance of adversity, the potential of pain. Take our finances for example. It is feasible that we might lose our jobs. We could run out of money, and not be able to pay all of our bills. We might not be able to afford to give a rent cheque next month.

These are problems, and all problems have solutions. The dilemma comes not from the problem, but from the reaction we have to the problem. Does the unknown scare you? Does that fear keep you from action? Do you know where your money is going?

The best response to this financial fear is abolishing the ignorance surrounding your money situation. If you are so afraid of your finances that you are scared to open up your bank account, or rip open the credit card envelope, then you need to take action now. Sometimes the truth will be better than what you thought, and sometimes it will be worse. Regardless, the only way to overcome the problem is by properly identifying what it is. Only then can you begin to come up with a solution. You can't solve a problem you don't understand.

Are you afraid? Don't delay. Don't think the problem will solve itself, or that someone will bail you out. Its time for us to grow up, own our money, and take responsibility for ourselves. Don't know where to start? Try keeping track of your spending with a spending record. Can't keep from spending every dollar that you earn? Try automatically putting it into a high interest online bank account. Face your financial fear. Understand and accept your situation, and from there, we can work on a solution.

Mar 18, 2009

The Credit Crisis Explained

So, apparently the economy is in a "recession".

Now, I know enough about what is going on in the United States there to understand that it does not really affect me. In fact, it someways, is quite good for my personal situation. However, a lot of people seem to not understand what is going on, and that ignorance has led to fear. So, in order to help you understand what exactly happened, please watch this video.

The Crisis of Credit Visualized from Jonathan Jarvis on Vimeo.

How Does/Will This Affect Me?

As the video explains, the credit crisis in the states has resulted in two primary consequences. First, housing prices has dropped. This does not really mean anything to us up here in Canada, because our housing market is quite separated from the United States. Economically we are closely tied, so the value of homes may drop as well, but not nearly to the same extent. Only a few people are losing their homes (as far as I am aware), and most people who owned their house were planning on staying in it anyways. The dip in the housing market will only affect those who were already planning on purchasing or selling real estate within the next year or so. After that, things should be back to normal.

The good news is that for those of us that are renting, the rental market (at least in North Vancouver) has dropped significantly over the last 8-12 months, meaning that I can now afford more home for less money!

The second consequence from the credit crisis is one of the more publicized areas of effect. The stock market has taken a bit of a tumble. You may have heard of this "Dow" figure dropping. The Dow is merely an indication of how well the stock market is doing, and currently, it is not doing so well. A lot of people have invested money into the stock market because historically it earns a high interest rate. Unfortunately, because of the dip in the market, some people have lost around 40% of their portfolio. For example, a person would have bought 1000 shares of Stock A over the past five years. Each month, they would get a statement saying what their 1000 shares were worth. This number would slowly increase, telling them that if they wanted to, they could then sell those shares for a profit, the point of investing.

At the moment, those same investors still have 1000 shares of Stock A, but that stock is worth much less than it used to be. This is a cause for concern only if that person were planning on selling that stock right at this moment. Otherwise, if you look at the stock market historically, this recession, this dip in the market, is temporary, and the worth of that stock will eventually return to what it was worth a year ago, and continue to rise.

So for me, the credit crisis means nothing but opportunity. I do not own a home, nor do I have any investments. The majority of the people that I spend time with are in similar situations. If anything, this credit crisis is the birth of possibility. Housing and rental prices are down, a perfect time for me to move (which I was planning on doing anyways). Stock prices are down, meaning that I can get the same commodity at a much cheaper price. If I believe that the stock market will rise over the next five to ten years (and historically, it always has), then now would be a perfect time to start investing.

I just wish that I had some money to invest, because now would be a great time to get involved in the market. Does the credit crisis worry you? Did you lose any investments? Are you worried for the future? Sound off.

Now, I know enough about what is going on in the United States there to understand that it does not really affect me. In fact, it someways, is quite good for my personal situation. However, a lot of people seem to not understand what is going on, and that ignorance has led to fear. So, in order to help you understand what exactly happened, please watch this video.

The Crisis of Credit Visualized from Jonathan Jarvis on Vimeo.

How Does/Will This Affect Me?

As the video explains, the credit crisis in the states has resulted in two primary consequences. First, housing prices has dropped. This does not really mean anything to us up here in Canada, because our housing market is quite separated from the United States. Economically we are closely tied, so the value of homes may drop as well, but not nearly to the same extent. Only a few people are losing their homes (as far as I am aware), and most people who owned their house were planning on staying in it anyways. The dip in the housing market will only affect those who were already planning on purchasing or selling real estate within the next year or so. After that, things should be back to normal.

The good news is that for those of us that are renting, the rental market (at least in North Vancouver) has dropped significantly over the last 8-12 months, meaning that I can now afford more home for less money!

The second consequence from the credit crisis is one of the more publicized areas of effect. The stock market has taken a bit of a tumble. You may have heard of this "Dow" figure dropping. The Dow is merely an indication of how well the stock market is doing, and currently, it is not doing so well. A lot of people have invested money into the stock market because historically it earns a high interest rate. Unfortunately, because of the dip in the market, some people have lost around 40% of their portfolio. For example, a person would have bought 1000 shares of Stock A over the past five years. Each month, they would get a statement saying what their 1000 shares were worth. This number would slowly increase, telling them that if they wanted to, they could then sell those shares for a profit, the point of investing.

At the moment, those same investors still have 1000 shares of Stock A, but that stock is worth much less than it used to be. This is a cause for concern only if that person were planning on selling that stock right at this moment. Otherwise, if you look at the stock market historically, this recession, this dip in the market, is temporary, and the worth of that stock will eventually return to what it was worth a year ago, and continue to rise.

So for me, the credit crisis means nothing but opportunity. I do not own a home, nor do I have any investments. The majority of the people that I spend time with are in similar situations. If anything, this credit crisis is the birth of possibility. Housing and rental prices are down, a perfect time for me to move (which I was planning on doing anyways). Stock prices are down, meaning that I can get the same commodity at a much cheaper price. If I believe that the stock market will rise over the next five to ten years (and historically, it always has), then now would be a perfect time to start investing.

I just wish that I had some money to invest, because now would be a great time to get involved in the market. Does the credit crisis worry you? Did you lose any investments? Are you worried for the future? Sound off.

Mar 17, 2009

Motivation

One of my dreams is to be able to earn an income writing. A few weeks ago I took the first baby step by signing up to produce content for Associated Content. It was a slow start, but that was exactly what I expected. So far, I've earned a whopping twelve cents from AC. That number is based off of the 5 articles that I've written for the website, all of which were published. My most popular one, to date, is the introduction to mixed martial arts. If I look at that as an hourly rate, I am probably make one to two cents per hour of work. Not the best return for my time.

At the same time I signed on to be a part of The Great Blog Off, a month long foray into the world of competitive blogging. This means that I have a lot more writing to do in my spare time compared to what I did a month ago. Combining these two new projects alongside my regular work schedule, planning a wedding, looking for a new place to live, and maintaining friendships means that I don't always have the chance to write when I want to.

Lately, when I do get the chance to write, I don't always want to write articles for AC. I have a couple ideas for articles that I want to write, I just haven't had the motivation to sit down and work through them. Instead, I've had a number of ideas for this here blog, and have pre-written a number of potential posts. A few weeks ago, I spent a Saturday writing and I wrote three of the articles that are now on AC, yet I couldn't find anything to write for the blog.

The wonderful benefit of writing for myself is that I can work on whatever I'm inspired to write on. If I want to blog about budgeting, I can do that. If I am excited about the articles that I wrote for AC, I can publish a post sharing my excitement. If I want to write about MMA, I will do just that.

This is why I want to be a writer. I want to be able to work on what I want, as I want, when I want, and where I want. It is part of the ethos of personal freedom, financial and otherwise, that I am striving to achieve in my life.

At the same time I signed on to be a part of The Great Blog Off, a month long foray into the world of competitive blogging. This means that I have a lot more writing to do in my spare time compared to what I did a month ago. Combining these two new projects alongside my regular work schedule, planning a wedding, looking for a new place to live, and maintaining friendships means that I don't always have the chance to write when I want to.

Lately, when I do get the chance to write, I don't always want to write articles for AC. I have a couple ideas for articles that I want to write, I just haven't had the motivation to sit down and work through them. Instead, I've had a number of ideas for this here blog, and have pre-written a number of potential posts. A few weeks ago, I spent a Saturday writing and I wrote three of the articles that are now on AC, yet I couldn't find anything to write for the blog.

The wonderful benefit of writing for myself is that I can work on whatever I'm inspired to write on. If I want to blog about budgeting, I can do that. If I am excited about the articles that I wrote for AC, I can publish a post sharing my excitement. If I want to write about MMA, I will do just that.

This is why I want to be a writer. I want to be able to work on what I want, as I want, when I want, and where I want. It is part of the ethos of personal freedom, financial and otherwise, that I am striving to achieve in my life.

Mar 16, 2009

How To Track Your Spending With a Spending Record

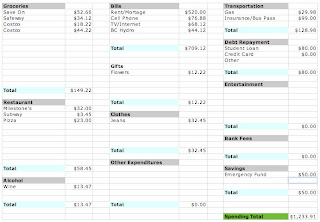

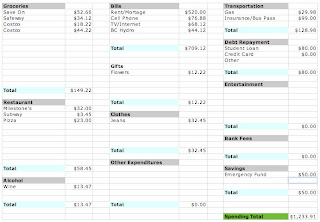

How intimate are you with your spending? One of the first things that I did when I started getting interested in my personal finances was to develop a spending record. It took on a number of variations at first, starting as a few scribbled notes on a piece of paper, or a list in a text document. Eventually, it turned into a multi-paged spreadsheet, and someday I am sure it will evolve yet again. All of the different versions boiled down to the same basic principle - where was I spending my money?

I think a lot of us think we know where our money goes. We might not write it down or record it, but we don't need to. We know approximately how much money is in the bank, and we know about how much we've bought. If we think hard, we might even be able to label prices with purchases. For example, a Subway sandwich costs three and a half dollars, and when we went to see the movie last week we spent $20. However, I think the reality of our spending is completely different from what we think it is.

For example, when I started recording where I was spending my money, I was shocked to see how much money I was spending at the grocery store. I knew I was eating a lot of food, and that I especially enjoyed ice cream and snacks, but I had no idea I was spending $300-350 a month on groceries. I thought I was spending $150, maybe $200, but certainly not twice that. It is downright shocking to add up how much money I was spending on certain categories. Not all the surprises were bad. I thought I was buying a lot of beer, but it averaged to about $20 a month, not including if I purchased something while I was out for dinner.

Tracking my money was the first step towards financial responsibility. Before I was keeping track of my spending I thought I was being responsible, because I wasn't spending more money than I made, at least most of the time. Financial ignorance, however, is often irresponsible, and there are no excuses for it.

Now, keeping track of spending doesn't have to be a difficult thing. You might think that you'll have to start getting receipts for everything, or writing down all your purchases as you make them throughout the month. While this does work, and is highly recommended for some people, I think that we are of a generation that will not put up with that hassle. Instead, I use the benefit of technology to assist me. I make almost all of my purchases using a debit or a credit card. I very, very rarely pay cash. This allows me to go back over my bank and credit card statements, and everything that I've purchased is listed for me. I just copy the numbers down onto my spread sheet and into the appropriate category. The spreadsheet even does all the adding for me, so that the totals are easily viewable. This works for me because I very rarely use cash. If you do use a lot of cash, it is not traceable after the fact, so you might have to start collecting those receipts. This whole process only takes me about 20 minutes every month. Sometimes I'll wait a couple of months and then go back over them all at once.

For me, I managed to bring down my average grocery bill to $190/month over the last three months. That's a savings of about $110/month. I think that just the recognition of the overall monthly cost of silly snacks or food that went bad made me a little more hesitant in Safeway and at Costco. It's a quick and easy way to save money, and at the same time, you're informing yourself of your spending habits so you can plan for them in the future.

What about you? Where are you spending more money than you thought you were? Where are you spending less? Any place you think you can reduce costs without much effort? Put that savings into your high interest online savings account!

Potential savings: $30+ per month. Total savings this month: $43

Want a copy of that spreadsheet for your own, personal use? Comment below, or on the wall of The Great Blog Off and ask for one.

I think a lot of us think we know where our money goes. We might not write it down or record it, but we don't need to. We know approximately how much money is in the bank, and we know about how much we've bought. If we think hard, we might even be able to label prices with purchases. For example, a Subway sandwich costs three and a half dollars, and when we went to see the movie last week we spent $20. However, I think the reality of our spending is completely different from what we think it is.

For example, when I started recording where I was spending my money, I was shocked to see how much money I was spending at the grocery store. I knew I was eating a lot of food, and that I especially enjoyed ice cream and snacks, but I had no idea I was spending $300-350 a month on groceries. I thought I was spending $150, maybe $200, but certainly not twice that. It is downright shocking to add up how much money I was spending on certain categories. Not all the surprises were bad. I thought I was buying a lot of beer, but it averaged to about $20 a month, not including if I purchased something while I was out for dinner.

Tracking my money was the first step towards financial responsibility. Before I was keeping track of my spending I thought I was being responsible, because I wasn't spending more money than I made, at least most of the time. Financial ignorance, however, is often irresponsible, and there are no excuses for it.

Now, keeping track of spending doesn't have to be a difficult thing. You might think that you'll have to start getting receipts for everything, or writing down all your purchases as you make them throughout the month. While this does work, and is highly recommended for some people, I think that we are of a generation that will not put up with that hassle. Instead, I use the benefit of technology to assist me. I make almost all of my purchases using a debit or a credit card. I very, very rarely pay cash. This allows me to go back over my bank and credit card statements, and everything that I've purchased is listed for me. I just copy the numbers down onto my spread sheet and into the appropriate category. The spreadsheet even does all the adding for me, so that the totals are easily viewable. This works for me because I very rarely use cash. If you do use a lot of cash, it is not traceable after the fact, so you might have to start collecting those receipts. This whole process only takes me about 20 minutes every month. Sometimes I'll wait a couple of months and then go back over them all at once.

For me, I managed to bring down my average grocery bill to $190/month over the last three months. That's a savings of about $110/month. I think that just the recognition of the overall monthly cost of silly snacks or food that went bad made me a little more hesitant in Safeway and at Costco. It's a quick and easy way to save money, and at the same time, you're informing yourself of your spending habits so you can plan for them in the future.

What about you? Where are you spending more money than you thought you were? Where are you spending less? Any place you think you can reduce costs without much effort? Put that savings into your high interest online savings account!

Potential savings: $30+ per month. Total savings this month: $43

Want a copy of that spreadsheet for your own, personal use? Comment below, or on the wall of The Great Blog Off and ask for one.

Subscribe to:

Comments (Atom)