What is a good hourly wage to earn while you are not working?

What's your time worth? Need to save some extra money quickly? Want something to put into

your online savings account? Then perhaps you should invest a little time and a little effort over the next few days and you could earn yourself anywhere from $20 to $100/hour simply by saving money on your fixed expenses.

ExpensesWhen we talk about expenses, there are two basic categories. There are fixed expenses, and there are variable expenses. Fixed expenses are the bills that you pay on a monthly basis, bills like your cell phone, your TV, your internet, your electricity, your rent, etc. Variable expenses are expenses that change on a monthly basis due to different circumstances. That would be purchases like food, clothing, or entertainment. So when you are looking into saving money, you should consider cutting both variable and fixed expenses.

Personally, I like cutting fixed expenses, because it offers the highest reward for the least amount of time. You cut one monthly expense, and you can continue to reap the benefit every month thereafter.

How To Easily Reduce Fixed ExpensesThere are two main ways to easily reduce fixed expenses. The first is to eliminate everything that you don't need. The question of what you need and don't need is a complicated one, and is something that you have to come to terms with yourself. The second method is relatively simple. You get in contact with the person that is providing you the service you require, and ask them to let you pay less.

This may sound ridiculous, and there are plenty of reasons why the company you are dealing with would never just give you back your money. However, about two weeks ago I called my TV and internet provider, and within 15 minutes I had reduced my bill by $40 a month for the next six months. That's a total savings of $240, for a few minutes of work. But wait! Before you call your provider, you are going to need to be prepared.

Step One: Determine Which Bill You Are Going to ReduceThere are plenty of possibilities here. Almost all of us have some sort of fixed expense that we could use reducing. We might be paying for a mortgage, for rent, for utilities, for phone service, for internet service, for television, for rentals or anything else. Now, narrow down your choices by prioritizing the bills by how much extra you think you are paying and by how easily they might be reduced (mortgage would need to be refinanced, so not so easy). Once you have an idea of which expense you are going to try to save money on, go ahead and get the last copy of your bill.

What I did was head on over to my cable provider's website (I get e-bills). I was actually able to look over the last year of my account with them. It listed all the different charges that I had through the company, as well as the different promotional discounts that I was also eligible for. I found out that I was paying $55/month for internet, and because of a promotion, $19/month for full cable television. The total was about $80/month after taxes.

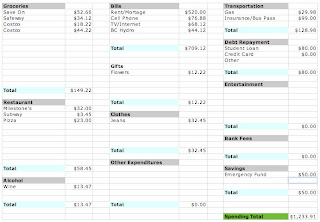

Fig. 1 - Cable/TV bill post-negotiation

Fig. 1 - Cable/TV bill post-negotiationAfter I saw how much I was paying for cable, I checked out all my options for internet and television. I looked at

Telus's internet packages, and

their television promotions. I also looked at

Roger's website, but they don't offer what I'm looking for. Finally, I remembered to check out Shaw's bundle pricing, to see if they were offering anything to new subscribers that they weren't offering me. What I found out what that I was already paying a pretty low price, because of the TV promotion that I had signed up for back in the summer. If I kept the same features, I'd be paying at least $80 a month (same price I was already paying), and with Shaw, I would be paying $97 a month!

So am I resigned to continue paying my $80/month bill? No! There are yet other alternatives. Do I need the internet? Do I need television? I found out that I wasn't watching too much of the tele, so perhaps I could eliminate it altogether and save myself $20/month. Do I need the internet? Well, yes, but do I need to pay an extra $10/month for a slightly faster internet? No, I probably don't. So there's $30/month.

If you're looking to do the same, check all the competitors in your area. If you live in British Columbia, in Canada, then check out the following major providers. Be sure to check for local providers, as they tend to offer nice deals that only small providers can.

Internet:

Shaw CableTelusRogersBellTelevision:

Shaw CableTelusBellStar ChoiceCell Phone Service:

RogersFidoBellTelusVirgin MobileKoodo MobileThere may be more options out there, but that list should get you started.

So you've determined which bill you are going to reduce, you've found your latest copy of your bill, you found out the best deal that you can get, and now you're ready to call your provider.

Step Three: The Phone CallBefore you pick up the phone and dial the number, take a deep breath and remind yourself of a few important principles. First, you are not entitled to a deal, you are asking for one. Act and speak humbly. Two, the person you are talking to is a human being, so treat them as one. They are just doing their job, and if they deny your request, feel free to be persistent, but do not be pushy or arrogant. You can always hang up and try again with another call center representative.

Now, call the number. Your first intention is to get in contact with someone who can get you a deal. Either use the phone tree to direct yourself to "downgrade service", "cancel service" or to a "retention" representative, or just mention that you'd like to eliminate or cancel your service to the first person you speak with. This is because the regular reps will not have the power to change your service, cancel it, or give you a discount. The employees working for retention can.

When you get the right person on the phone, state clearly what you're looking for. I said that I couldn't afford to keep the services that I had, so I was looking to eliminate the television service from my account. I also mentioned that I could get Telus internet for cheaper than Shaw. At this point, the rep got a little upset, and started explaining why Shaw was so much better than Telus. I just calmly explained that cheaper is cheaper, and that I needed to save some money. I also admitted that I did not want to switch services, as I had been with Shaw for awhile and did not want to go through the hassle of switching. So I asked if they could do anything for me to keep my business.

The rep went on hold for a minute, and came back with an offer to keep my TV bill $30 lower than it ought to be for six more months, and to give me an upgrade to a higher speed internet (which I was paying $10/month for) for free. So $40/month savings, total. I gladly accepted, thanked the rep, and called it a day.

15 minutes research, 15 minute phone call, $40/month for 6 months = $240.

"hourly rate" = $480/hour

Think you can do better? Sound off.

More InformationHow to Reduce Your Credit Card Interest RatesHow One Guy Reduced His Television Bill By 15%Television AlternativesHow to Optimize Your Cellphone BillPotential savings: $20+ per month. Total savings this month: $63